Irish foodservice sector rebounds to pre-pandemic levels, but significant challenges are on the horizon – Bord Bia report

Eating out-of-home trends show ‘Thursday is the new Friday’ and dining out for breakfast is back on the table

@bordbia | #foodservice22

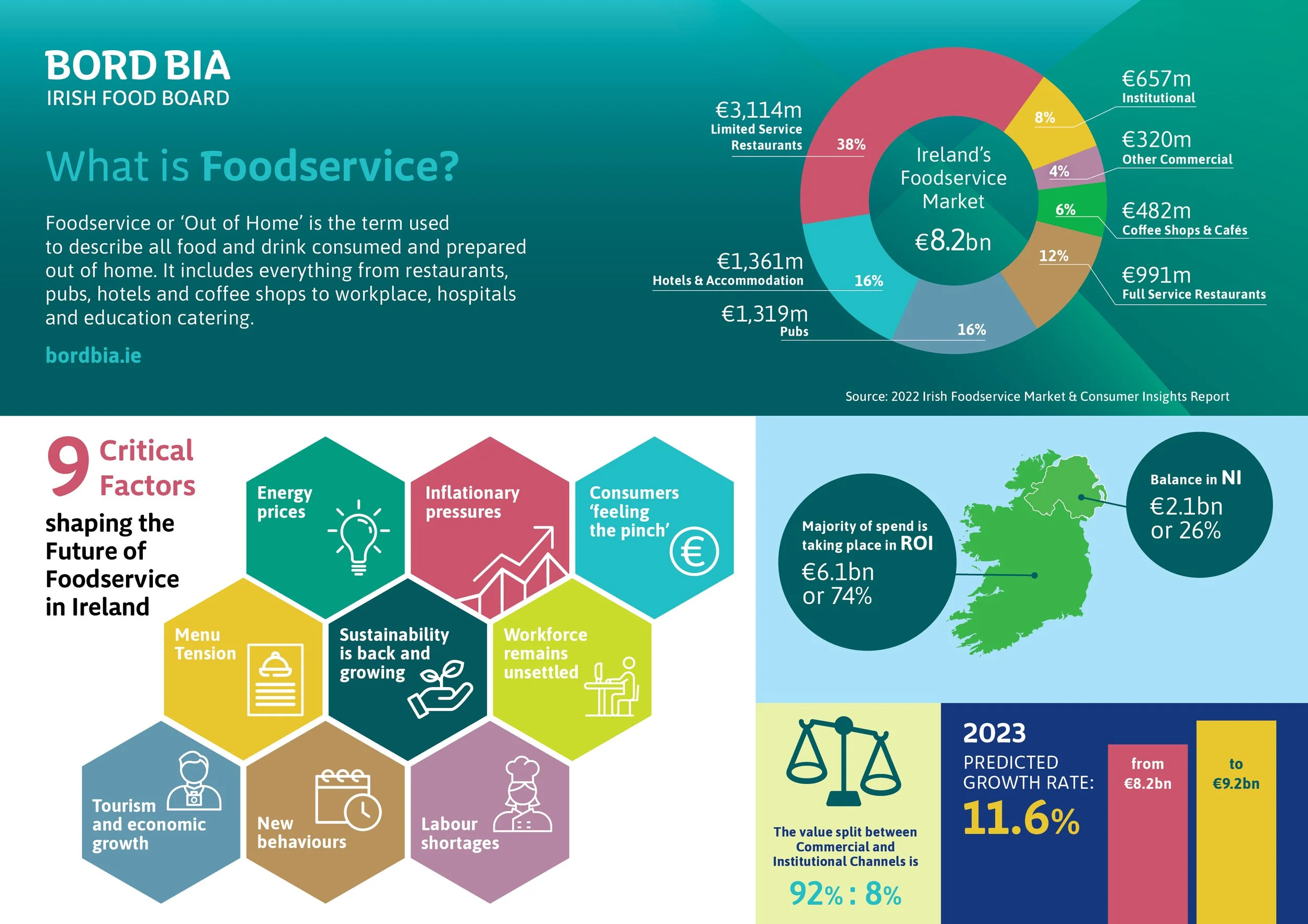

The findings of Bord Bia’s 2022 Irish Foodservice Market Insights Report released today show that the Irish foodservice, or ‘out of home’, industry experienced significant growth of 61% in value to reach over €8.2 billion this year. This represents an almost full recovery to pre-pandemic levels, but it is set against a forecast for modest growth of 11.6% in 2023 (predicted to be fuelled mainly by cost inflation, rather than consumer visits).

According to the research, 8 in 10 (76%) Irish consumers say that they are enjoying the social aspect of dining out now that Covid-19 public health restrictions have been fully lifted. However, with 8 in 10 consumers (77%) concerned about their finances, many are changing their out-of-home consumption to reduce costs. The report identifies a number of growth opportunities for the foodservice sector in response to changing consumer behaviours. This includes the rise in popularity of eating out on Thursday evenings rather than Friday, lunch and early dinners replacing late-night eating and the return in demand for eating breakfast out of home.

Maureen Gahan, Foodservice Specialist, Bord Bia said, “Certainly, for many companies, the boom seen in 2022 has been a welcome return to growth, but most acknowledge that looking ahead to 2023, projections are perhaps just as challenging as they were at the height of the pandemic. Significant economic headwinds remain in place, including higher inflation, rising interest rates, global uncertainty and rising energy prices, all of which are likely to create consumer pull back and add to existing industry challenges.”

Gahan continued: “Today’s report identifies a number of trends and key imperatives for Irish food and beverage suppliers to familiarise themselves with in order to ensure that their own businesses remain relevant to industry needs moving into next year. There is no doubt that suppliers can play an important role in helping operators to navigate ongoing challenges facing the sector and we would encourage them to work collaboratively in helping to identify future solutions. This could include creating labour-saving products, providing transparency around environmental and sustainability messages and enhancing communications around supply chain issues. The industry is also looking for suppliers to come to them with innovative menu offerings that can create consumer excitement and drive repeat visits.”

Critical Factors Facing the Foodservice Sector

Within the report, Bord Bia has identified nine critical factors which the Irish foodservice sector and suppliers should consider as we move into 2023. These include:

Energy Prices - Higher domestic energy bills are likely to suppress consumer demand during the winter. Energy bills are also significantly impacting foodservice operators at a time when all costs are increasing.

Inflationary Pressures - Inflation has caused industry growth and valuation to recover quicker than anticipated, but it also creates challenges for consumers. Much of the growth in 2023 is expected to be inflation-driven, with modest growth (if any) in consumer visits.

Labour Shortages - Labour shortages are expected to persist into 2023. Ongoing shortages will have implications on overall industry sales and on operators’ ability to drive growth. Additional labour-saving initiatives and products will remain in high demand throughout 2023 and beyond.

Consumers ‘Feeling the Pinch’ – As cost continues to pose a challenge to consumers, they will need to see value in dining out beyond the menu price. Delivering a memorable consumer experience is still important to many and take-aways have remained popular amongst younger consumers.

New Consumer Behaviours - The industry has seen behaviour changes driven by shifts in hybrid work and labour shortages. For many, Thursday is the new Friday, and lunch and earlier dinners are often replacing evening or late-night occasions. There is an opportunity to develop solutions for new and emerging dayparts. With an increase in consumers ‘on the go’ and a return of office workers (albeit on a hybrid basis), the popularity of breakfast out of home has returned and offers further growth potential.

Menu Tension - With concern around cost, operators have mostly simplified their menus with limited innovation. While there is a desire for new product development, much of the innovation we are seeing is around cost control. There is, however a recognised need for new menu items to maintain consumer interest and drive visits.

Compressed Margins - While operators have raised menu prices significantly, many of them are not passing on full cost increases and so this has resulted in additional margin compression.

Sustainability - Sustainability has returned to the fore for many operators. In today’s environment, much of this is driven by a desire to save on costs (energy, food waste, etc.) as much as environmental concerns.

Tourism & Economic Growth - Ireland’s foodservice industry is still heavily impacted by the success of tourism. The global situation remains very much in flux, which points to a much more subdued demand for foodservice in 2023. Overall plans and strategies should reflect this likely new reality in terms of both sales and volume growth.

Bord Bia Foodservice Supports

Bord Bia provides a range of ongoing supports to the Irish foodservice industry including market updates and insights, networking and collaboration opportunities and an annual Foodservice Directory containing over 100 detailed profiles of foodservice operators and distributors. The foodservice seminar which takes place at the Killashee House Hotel, Naas from 9AM-3PM today will discuss emerging trends in the sector. The event will be chaired by business journalist, Richard Curran and feature contributions from Cathal Corcoran, Go Tiger; Austin McGinley, Fresh the Good Food Market; Grace Binchy, Bord Bia; Sheila Dowling, Bewleys; Philip Doran, Hello Fresh Ireland; Mick Kelly, GIY Ireland; Maria Castroviejo, Rabo Bank and Catherine Toolan, Diageo Irish Home Brands.

The full report is available to download from https://www.bordbia.ie/industry/insights/publications/2022-irish-foodservice-marketconsumer-insights-report/

Notes:

Definition of Foodservice Market

The foodservice market includes all food and drink consumed and prepared out of home incorporating restaurants, pubs, hotels, coffee shops, workplace catering, hospitals, education and vending. Figures included in this report exclude alcohol sales.

About the Research

For the development of this study, Bord Bia collaborated closely with Technomic, a global food consultancy with 50+ years of expertise in the out of home channel and Opinions, a full-service market research agency to deliver insights necessary to develop detailed market strategies and to highlight potential opportunities.

Technomic Research

Building on its industry forecasts issued as part of a White Paper in June 2022, Bord Bia and Technomic have revisited the situation across all foodservice sectors and have updated and revised the performance for the industry in 2022, as well as expectations for 2023. Note that while these figures are shown as full-year 2022 results, they presume to forecast the last two months of the year, and there remains some variability in recent weeks, particularly as energy bills are starting to be felt by consumers and operators alike. For 2022 and to project sales for 2023, Technomic’s forecasting model is built on a month-by-month evaluation of the sales level for that month against the baseline 2019 monthly revenue numbers as well as against sales levels from the previous year. Note that while this report does not attempt to forecast inflation, it is assumed that the majority of this 11.6% growth will be driven by higher prices passed on to the consumer.

Opinions Research

The consumer research involved a quantitative survey amongst a nationally representative sample of n=1,000 adults in Republic of Ireland (ROI). This was then boosted with n=315 adults in Northern Ireland (NI). A total sample of n=1,315 adults was achieved. The error margin for this data is estimated at +/- 3%. This was the third and final of three waves of research conducted in Ireland. Fieldwork was conducted from 13th – 23rd September 2022.